Skyline Industrial REIT fait l’objet d’un article sur RENX.ca concernant les propriétés qu’il a acquises au Québec et en Ontario

Mike Bonneveld, président de Skyline Industrial REIT, a fait l’objet d’un article publié dernièrement sur le site RENX.ca, qui portait sur les récentes acquisitions du FPI au Québec et en Ontario

[Guelph (Ontario) – Le 20 novembre 2023]

Mike Bonneveld, président de Skyline Industrial REIT, a fait l’objet d’un article publié dernièrement sur le site RENX.ca, qui portait sur les récentes acquisitions du FPI au Québec et en Ontario.

L’article met en valeur les résultats et la stratégie du FPI. Rappelons que Skyline Industrial REIT vient d’achever son programme de dispositions stratégiques, qui consistait à délaisser les espaces industriels relativement petits et anciens pour se tourner vers des projets plus vastes, plus modernes et construits à des fins particulières dans le secteur de l’entreposage industriel, de la distribution et de la logistique, conformément à sa nouvelle vision.

Pour en savoir plus sur Skyline Industrial REIT, rendez-vous sur le site SkylineIndustrialREIT.ca.

L’article ci-dessous est une reproduction de la publication originale. Cliquez ou tapez ici pour lire l’article original publié sur le site RENX.ca.**Veuillez noter que l’article a été publié en anglais seulement.

Skyline Industrial acquires new Quebec, Ontario properties

Guelph-based REIT also sold almost 500,000 sq. ft. of industrial assets in September

Skyline Industrial REIT has acquired two newly constructed assets in Quebec and Ontario as it continues to increase its weighting in more modern properties across Canada.

“We’re being selective as we acquire assets right now,” president Mike Bonneveld told RENX, “but I think we’re one of the few groups that’s actively out there looking for assets.”

Skyline’s balance sheet is in a good position, according to Bonneveld, after pruning its portfolio with the disposition of its last office property in February and the sale of other non-core assets over the past few years.

“We got ahead of the curve and I’d love to say we were really smart and knew what was coming, but there was also luck involved,” Bonneveld explained.

“It’s put us in a really good spot where we can be a bit picky and be able to acquire good assets when lots of guys are ‘pens down’.”

Quebec cold-storage facility leased to Congebec

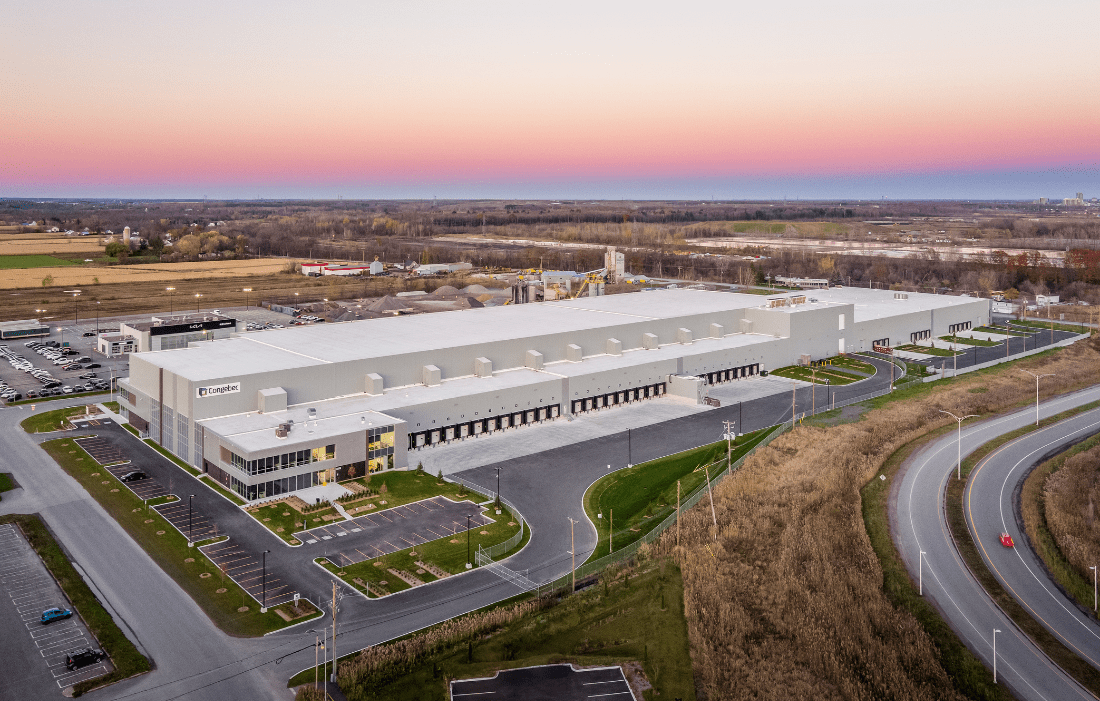

Skyline acquired the interests of its development partner, Rosefellow, and is now the sole owner of a facility at 3601 Avenue de la Gare in Mascouche, Que., an off-island suburb of Montreal.

Construction was completed in late September on the multi-tenant development totalling 321,000 square feet. A 226,000-square-foot cold-storage facility with a 32-foot clear height is being used entirely by Congebec.

Bonneveld said Congebec had approached the trust and other developers several years ago about its desire for a new building in the Montreal area. The site in Mascouche was acquired for that purpose based on the cold- and multi-temperature storage, warehousing and distribution company committing to a 20-year lease for the new development.

Montreal-based Rosefellow owned a small stake in the property and the plan was always for Skyline to acquire it upon completion of the building.

Skyline is in lease negotiations for the site’s remaining dry-storage space. Bonneveld is looking to close a deal for about 60 per cent of it very shortly and two other tenants are interested in the remaining space, so he’s hopeful it will be fully leased before the end of the year.

Other Rosefellow partnership developments

Skyline is in partnership with Rosefellow on seven developments in the Montreal area and two in Ottawa. Seven are at various stages of development and Bonneveld said they’re on or ahead of schedule from both construction and leasing standpoints.

Two Montreal projects are essentially finished and 100 per cent leased.

“We are working with Rosefellow and our other equity partner in there to buy them out of both of those, and the hope is that those will close in Q1 of ’24,” Bonneveld said.

Second Woodstock, Ont. acquisition

Skyline also acquired a 148,050-square-foot building with a 28-foot clear height and 16 shipping doors at 353 Griffin Way in Woodstock, Ont. It was completed in October and is fully leased long-term to IPEX.

Bonneveld said the deal was brought to Skyline from a broker late in 2022 when it was in the early construction stages. It was developed by Paris, Ont.-based 214 Carson Co. and acquired by Skyline for $28.5 million.

Skyline acquired another Woodstock property in a small industrial node just off Hwy. 401 last year and Bonneveld said it has become popular with manufacturers and logistics companies, so he was happy to purchase another asset in the area.

“For tenants, it’s a bit of a rent discount compared to Kitchener-Waterloo and Brantford, but it’s a brand new building that’s really well-built,” he said. “IPEX is a very strong tenant, so getting a long-term lease with annual escalations, from what I think is a really good starting rent in terms of cost per square foot, gives us a really nice entry point.”

Skyline is doing due diligence on two other potential acquisitions, one of which Bonneveld hopes to close before Christmas and another that’s at an earlier stage.

September dispositions

Skyline sold 12 non-core assets totalling 485,488 square feet across four provinces, in two separate transactions, in September.

Cervus Equipment Corporation was leasing 11 light industrial/showroom spaces totalling 364,954 square feet in Alberta, Saskatchewan and Manitoba when it was acquired by Brandt Tractor Ltd. a year ago. The new owner preferred owning its properties over leasing them and an off-market deal was struck to acquire them from Skyline for $68 million.

Skyline also sold an older 120,534-square-foot cold-storage facility at 7801 Boulevard Henri-Bourassa E. in Montreal.

Congebec had occupied the facility and Bonneveld said “we had an agreement where we would let them out of their lease if we were able to re-lease to an equal or better tenant and then sell the building off to a third party, which we did.”

Skyline completed a lease agreement for the entire facility with Confederation Freezers and then sold the property for $22.6 million.

Capital from those sales will be put toward acquisitions and development.

“We’re done the strategic disposition program and there’s really not much, if anything, that’s targeted for sale,” Bonneveld said in reference to the sale of non-core assets.

The firm’s current focus is on acquiring warehousing and logistics-centred properties along major highway corridors and transportation routes.

Skyline will, however, consider selling properties if it’s approached with an attractive offer.

Skyline now owns 49 properties

Guelph, Ont.-based Skyline is now 84 per cent weighted in warehousing, distribution and logistics-focused assets. The portfolio comprises 49 properties in five provinces with a total of 9,196,171 square feet of industrial space.

Skyline is a privately owned and managed real estate investment trust that launched in 2012. It’s distributed as an alternative investment product through Skyline Wealth Management Inc.

The REIT’s properties are managed by Skyline Commercial Management, a commercial real estate property management company housed within Skyline Group of Companies.

About Skyline Industrial REIT

Skyline Industrial REIT (the “REIT”) is a privately owned and managed portfolio of industrial properties, focused on acquiring warehousing and logistics-centred properties along major highway corridors and transportation routes in Canada.

Skyline Industrial REIT is distributed as an alternative investment product through Skyline Wealth Management Inc. (“Skyline Wealth Management”), the preferred Exempt Market Dealer for the REIT. It is also available on Fundserv (Code: SKY2012).

Skyline Industrial REIT is committed to providing outstanding places to do business and superior service to its tenants, while surfacing value with a goal to deliver stable returns to its investors.

To learn more about Skyline Industrial REIT, please visit SkylineIndustrialREIT.ca.

To learn about additional alternative investment products offered through Skyline Wealth Management, please visit SkylineWealth.ca.

Skyline Industrial REIT is operated and managed by Skyline Group of Companies.

Demandes de renseignements des médias :

Cindy BeverlyVice-présidente, Marketing et communications

Skyline Group of Companies

5, rue Douglas, bureau 301

Guelph (Ontario) N1H 2S8

519.826.0439 x602