Canadian Apartment Magazine: Skyline’s New Heights

THE SKY IS THE LIMIT WHEN YOU TAKE THREE YOUNG, AMBITIOUS, LIKE-MINDED UNIVERSITY STUDENTS AND PLACE THEM ON THE ENTREPRENEURIAL PATH.

The Sky is the Limit When You Take Three Young, Ambitious, Like-Minded University Students and Place Them on the Entrepreneurial Path.

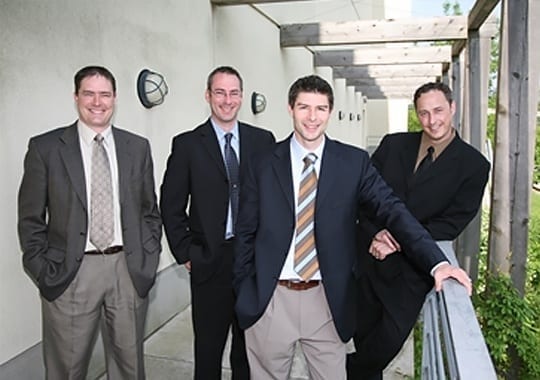

Jason Castellan, Martin Castellan and (Roy) Jason Ashdown tapped into the student rental housing market while attending university. In 1991, the Castellan brothers purchased their first rental house using student loans and borrowing from family and friends. At the same time, Ashdown was buying and managing rental properties of his own. Within eight years the three owned and managed 52 rental houses and five apartment buildings in Guelph and Cambridge. As their rental portfolio grew, the partners made the decision to formalize their developing business by incorporating Skyline in 1999.

“Throughout my life I’ve always been an entrepreneur,” says (Roy) Jason Ashdown, CSO, Skyline Incorporated. “I have always developed businesses of my own. I seem to have a knack for it and enjoy it, so I’m not surprised to find myself as an owner of a company with two partners of similar qualities. The way our company has grown has been very exciting. As we have gotten bigger and the pace has gotten faster, my enjoyment for this business has grown ten-fold.”

Now in their mid-30s, the trio bases its success on the diversity of skills and areas of expertise that each member contributes every day.

“Teamwork is important to all of us–we are all sports-minded and we equate a lot of things to the team and what we each bring to the table,” says Jason Castellan, CEO, Skyline Incorporated. “(Roy’s) Jason’s strengths are in operations. He makes the decisions and directs the management staff on the ground level. He motivates and supports the management team, the people that make our business successful.”

Martin Castellan is the company’s Director of Real Estate Development and founding partner of Skyline Incorporated. In his role, Martin concentrates on projects outside of the traditional multi-residential and commercial property portfolio. “To reflect on our achievements since 1991, it has been a great evolution so far and I am certainly looking forward to the future,” states Martin. “We have got a great team in place, one that allows me the opportunity to focus on development projects both inside and outside of our new REIT structure.”

“Martin’s entrepreneurial spirit is important for the company’s growth,” Jason says. “There are very few things that I have done in my life without partners because I think teammates can offer strengths that I do not have.” Jason says he depends on the strengths of the rest of the team while he focuses on acquiring and financing properties that are accretive to the Skyline portfolio.

The latest acquisition to the team is Wayne Byrd as Chief Financial Officer. After knowing the Castellan brothers and Ashdown for nearly eight years, Byrd joined the Skyline team in April 2005. “Wayne is the numbers guy, but more importantly, he is able to think beyond the numbers,” Jason Castellan says. “He has the ability to think strategically through our operations with a long-term vision on our investors’ best interests.”

The Growth of Skyline

Since the early ‘90s, Skyline Incorporated has grown its real estate holdings to a market value of $83.9 million across 29 properties in 10 different rural and urban centres. During this period of growth, industry peers and the investment community have recognized the company as a respected real estate asset manager. The company’s portfolio includes 1331 units and 165,000 sq. ft. of commercial space with a further 150 units worth $9.0 million under contract.

Although the company is small compared to some of the bigger players in the industry, Skyline is definitely in a growth phase. It has stayed true to developing a position in secondary markets, where most of the players have not.

Ashdown says the removal of third-party property management contracts in 2005 has allowed the company to concentrate on its core assets. Last year, the development of three regional managers (in Western, Central and Eastern Ontario) has helped the company grow in its respective areas. The regional management approach allows Skyline to be scalable, which makes it quickly responsive to growth.

The Road to REIT

On May 10, 2006, Skyline Incorporated amalgamated its portfolio, taking a step toward creating the Skyline Real Estate Investment Trust (Skyline REIT).

“It is going to be the most important vehicle in achieving our vision for growth,” says Byrd. Since his arrival in 2005, Byrd has been instrumental in completing the REIT structure with Stikeman Elliot LLP’s Toronto office through developing and finalizing the legal agreements.

The team approached lawyer David Ehrlich, Stikeman Elliot LLP, nearly a year ago to discuss how to grow and more efficiently access the capital markets. Ehrlich says he looked at the structure Skyline had in place and talked about various alternatives to make the company’s ‘next step’ more plausible. “We decided that Skyline really had a unique position to manage and build its company from the ground up. It also has the potential to continue growing without inheriting any other company’s assets or problems,” Ehrlich says. “We came up with an organizational structure that will accommodate the investments that it made previously in a different format, and mended that with a new investment vehicle as a private REIT.” Ehrlich says the goal was to put Skyline in a position that would give the company leverage if it decided to become a public REIT. “Skyline has a fairly unique strategy in that it wants to build a significant entity specializing in the smaller market,” Ehrlich adds.

“Becoming a REIT will provide an opportunity for us to grow by consolidating rural properties,” Byrd adds. “We are really focused on bringing added value to our acquired properties. We are able to purchase these buildings in secondary markets at a more attractive cap rate then what is traditionally being seen in metropolitan markets, and put some money towards them which brings additional value to our investors.”

With the recent structure change into a REIT and Skyline still being relatively small, Byrd anticipates that the next few years will be “very exciting for the company.” “Although we are not venturing into the public markets, I think the educated, long-term investor is going to see value in our private offerings as we strive towards our growth vision,” Byrd says.

Barry Gidney of First National Financial Corporation has worked with Skyline for the past eight years. As the company’s lender, he’s financed nearly half of their portfolio.

“I think becoming a REIT is going to give them more flexibility to raise capital, which they will need, and bigger exposure,” he says. “They have seen incredible growth and have managed that very well. They have chosen their properties carefully, diversified their markets and maintained a ‘hands on’ approach,” Gidney adds. “They are young and aggressive and they are not afraid to take risks. They tend to see value where others don’t see it. They have their own little market segment. They tend to stay out of Toronto. They stick to markets they know.” The Castellan brothers spent their childhood years in rural Walkerton, Ontario, and Ashdown grew up in the small community of Fergus, Ontario.

Although it may seem premature in the company’s career, Martin says becoming a REIT was a necessary step. “As the properties we bought got larger, the capital we needed to secure those properties grew too. We found our appetite for growth exceeding our access to capital, as more properties were being presented to us for acquisition,” he says. “By becoming a REIT we are opening doors to a larger and more diverse group of investors that will allow us to buy smarter, better, and faster.”

Jason Castellan adds that restructuring the company as a REIT allows it to “not only be competitive on the operations side of the business, but also provide the opportunity to more effectively grow with acquiring more properties.” To achieve this goal, Skyline is actively looking at acquiring both single buildings and portfolios. Jason Castellan says he is looking in secondary Ontario markets predominantly, and does not yet see an urgent need to look outside of the province for available product.

$500 Million is on the Skyline

The new REIT structure will allow the company to efficiently grow and acquire more properties, bringing it toward its $500 million vision by 2010.

“In 1999 Skyline purchased its first apartment building for $675,000 and we now find ourselves at 29 buildings and $84 million; we feel that we have taken a much bigger step in these past seven years than the road ahead of us growing to $500 million,” says Jason Castellan. “The hard work is already done by creating a strong foundation from which to build Skyline to $500 million.”

Skyline has created a solid platform to pursue and support its aggressive growth strategies; equally important is the team that the Castellans and Ashdown have formed around them. The three founders are poised to confidently move Skyline into the REIT market, alongside a new challenge of industry peers. The sky is the limit as Skyline looks to take its place on the horizon.