Is now a good time to invest in Canadian REITs?

As economic factors indicate a shift toward a real estate market comeback in late 2024 and continuing into 2025, investors may be wondering whether the time is right to invest in a Canadian REIT.

Canada’s real estate landscape is shifting under the influence of several key economic trends, making now an intriguing time for investors to explore real estate investment trusts (REITs). Easing interest rates, a strong population forecast, and expected GDP improvement are all factors that impact the real estate market and have signified a bounceback that is putting private Canadian REITs in the spotlight.

Amid an optimistic outlook toward brick-and-mortar investment, investors seeking portfolio diversification and enhanced returns on capital could consider Canadian REITs as a suitable investment option going forward.

What exactly is a REIT?

Many investors see REITs as a smart alternative to traditional property ownership. A REIT comprises a portfolio of real estate properties. By purchasing REIT units (similar to shares), you invest in the entire diversified property portfolio, which may include apartment buildings, logistics warehouses, or retail centres, to name a few. This type of investment has built-in diversification, spreading risk across multiple assets instead of relying on a single property’s performance, reducing exposure to market volatility.

Current market trends affecting Canadian REITs

Canadian REITs may be a particularly attractive investment option amid the real estate market bounceback, spurred on by a greater Canadian economic rebound like that predicted in CBRE’s 2024 Market Outlook. The report forecasted a “successful soft landing” for the Canadian economy, with a return to growth in the second half of 2024 and continuing into 2025.

Collectively, these macroeconomic trends support the indication that momentum is anticipated to project into the Canadian economy later this year, as well as through 2025 and beyond. Each economic trend has a direct impact on the Canadian real estate sector and suggests a compelling outlook for Canadian REIT performance.

Forecasted population growth

Canada’s population is experiencing an upward trend that is reshaping the real estate market and presenting a clear opportunity for investors.

Statistics Canada estimates that Canada’s population—which surged 3.2% in 2023—will grow to 45.4 million within the next decade. With an estimated 500,000 immigrants arriving annually, along with natural population growth, the need for housing and essential services continues to rise. This demand ripples across all real estate classes, driving the development, acquisition, and management of rental apartments, grocery-anchored retail centers, industrial warehouses, and more.

By investing in a Canadian REIT that holds one or more of these asset classes, investors can participate in Canada’s transformation and tap into long-term growth potential fuelled by a rapidly expanding population.

GDP improvement

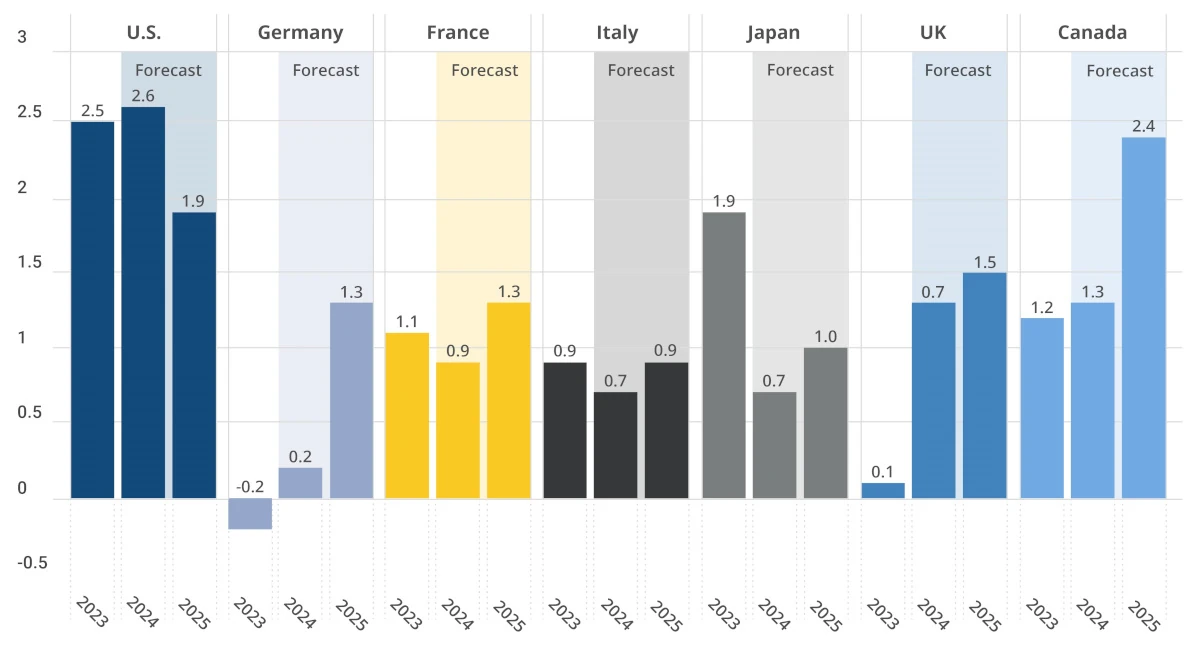

GDP is another factor that greatly influences all real estate market sectors and makes a strong case for considering Canadian REIT investments. Canada is forecast to lead the G7 countries over the next five years not only in population growth but also in overall GDP and employment, with 2.0% growth expected in 2025.

CBRE’s 2024 Market Outlook cites several unique factors contributing to Canada’s competitive advantage, including abundant natural resources that can contribute to Electric Vehicle (EV) battery production, a prudent banking system, and an economy that is overall comparatively sheltered from geopolitical risk.

The rise in overall demand for goods and services translates into demand for more brick-and-mortar spaces to allow for their production and sale. In other words, GDP can influence the anticipated growth of prominent real estate sectors such as industrial and retail, highlighting the potential benefits of investing in a private Canadian REIT that focuses on one or more of these asset types.

GDP Growth Among G7 Countries, 2023-2025

Source: IMF World Economic Outlook statistics as reported on FinancialPost.com and VisualCapitalist.com

Interest rate cuts

The Bank of Canada first introduced lower interest rates in June 2024 and followed up with further cuts in July, September, and October (the key rate currently sits at 3.75%).

Interest rate movement directly influences real estate market dynamics. Lower borrowing costs make it easier for REITs to acquire properties, refinance debt, and expand their portfolios—as well as generate higher returns.

Low interest rates also typically result in compressed capitalization rates (cap rates), which represent the return on investment properties. Cap rate compression causes a rise in property value, making real estate investment more attractive.

Investors are finding a “renewed optimism” in REITs as a smart way to capitalize on market opportunities while benefiting from favourable financing. With economic activity on the upswing, now is a prime moment for investors to harness the potential of Canadian REITs and participate in the real estate market’s recovery.

Why invest in a 100% Canadian REIT?

Investors navigating the diverse Canadian REIT landscape should consider the distinct advantages of choosing a REIT that focuses solely on Canadian assets over those with international holdings. Investing in a 100% Canadian REIT allows for a more tailored approach, capitalizing on local market knowledge and reducing exposure to geopolitical risk.

By concentrating on Canadian REITs that choose to invest exclusively in domestic properties, investors can support local economies while benefiting from a more stable and predictable investment environment.

REITs grounded in 100% Canadian real estate assets

With more than 25 years in the Canadian real estate industry, Skyline offers three private REITs, each a pure-play alternative investment focusing on 100% Canadian real estate properties.

- Skyline Apartment REIT is a portfolio of both established and newly developed multi-residential (apartment) properties in secondary and tertiary markets across Canada.

- Skyline Industrial REIT comprises industrial warehousing, distribution, and logistics properties strategically located along Canada’s major transportation routes and shipping corridors.

- Skyline Retail REIT focuses on acquiring grocery and pharmacy-anchored retail properties in Canada’s secondary and tertiary markets, where these properties act as major shopping hubs for the surrounding area.

Each of Skyline’s REIT investments offers the opportunity to access institutional-quality real estate without the headaches of property ownership. With dedicated expert management teams for each REIT, these funds have a proven track record of resilience in uncertain economic periods, and a stable return on investment since inception (as early as 2006 in the case of Skyline Apartment REIT). By investing in one of Skyline’s REITs, investors enjoy an opportunity for portfolio diversification and capital growth, as well as potential tax advantages.

Skyline currently owns and manages approximately $8.23 billion in assets among its REIT investments and clean energy fund. These investments have provided a historical annualized return of 9-14%.

Why Now is the Time for Canadian REIT Investment

Now may be an optimal time for investors to consider a Canadian REIT, as interest rates cool down, GDP is expected to improve, and statistical forecasts point toward continued population growth. Each of these factors has contributed to an expected real estate market rebound through the remainder of 2024 and into 2025, with private Canadian REITs highlighted as attention-worthy investment vehicles.

As with any investment, careful due diligence and evaluation is integral to understanding how a REIT may complement your investment portfolio, and whether it aligns with your investment objectives. Assessment of a REIT should include, but is not limited to, historical performance, strategy, management team, valuation, fees, and investment process. When carefully evaluated, Canadian REITs may be a smart choice for long-term investment.

Contact a Skyline representative today to learn more about Skyline’s investment products and discover how they may help you reach your investment goals.

About Skyline Group of Companies

Skyline Group of Companies (“Skyline”) is a fully integrated asset acquisition, management, development, and investment entity.

It is comprised of companies that provide services in real estate management and development, as well as clean energy management and development.

Skyline currently manages more than $8.23 billion across its real estate and clean energy platforms.

With approximately 1,000 employees across Canada, Skyline works to provide safe, clean, and comfortable places for tenants to call home, great places to do business, sustainable solutions for a greener future, and an engaging experience for its investors.

View Skyline’s 20th Anniversary celebration video to see how Skyline is grounded in real estate, powered by people, and growing for the future.

For more information about Skyline Group of Companies, please visit SkylineGroupOfCompanies.ca.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

519.826.0439 x602